Subsidy Programme for the Promotion and Distribution of Cinematographic and Television Works with Macao Elements

-

Subsidy Programme for the Promotion and Distribution of Cinematographic and Television Works with Macao Elements 2025 (1)

-

Subsidy Programme for the Promotion and Distribution of Cinematographic and Television Works with Macao Elements 2025 (2)

-

Subsidy Programme for the Promotion and Distribution of Cinematographic and Television Works with Macao Elements 2025 (3)

-

Subsidy Programme for the Promotion and Distribution of Cinematographic and Television Works with Macao Elements 2025 (4)

-

Subsidy Programme for the Promotion and Distribution of Cinematographic and Television Works with Macao Elements 2025 (5)

-

Subsidy Programme for the Promotion and Distribution of Cinematographic and Television Works with Macao Elements 2025 (6)

-

Objective

The Cultural Development Fund (FDC, from the Portuguese acronym) has established this Subsidy Programme, for the purposes of supporting the promotion and distribution of films and television programmes with Macao elements to promote the image of Macao.

-

Application period

2.1The application period is divided into three rounds . After each round closes, FDC will review all applications submitted during that period uniformly. There is no quota limit per round, however, the application period may end early when the budget of this Subsidy Programme is exhausted, which will be announced on the website of FDC. The application rounds are as follows: Round 1 9:00 a.m. on 3rd June to 12:00 p.m. on 30th June 2025 Round 2 0:00 a.m. on 1st July to 12:00 p.m. on 31st August 2025 Round 3 0:00 a.m. on 1st September to 5:30 p.m. on 28th November 2025

-

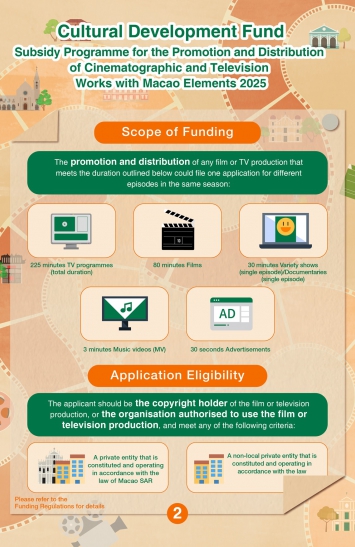

Scope of funding

3.1The promotion and distribution of any film or TV production that meets the duration outlined below could file one application for different episodes in the same season: 3.1.1TV programmes with a total duration of no less than 225 minutes; 3.1.2Films with a duration of no less than 80 minutes; 3.1.3Variety shows (single episode)/documentaries (single episode) with a duration of no less than 30 minutes; 3.1.4Music videos (MV) with a duration of no less than 3 minutes; 3.1.5Advertisements with a duration of no less than 30 seconds.

-

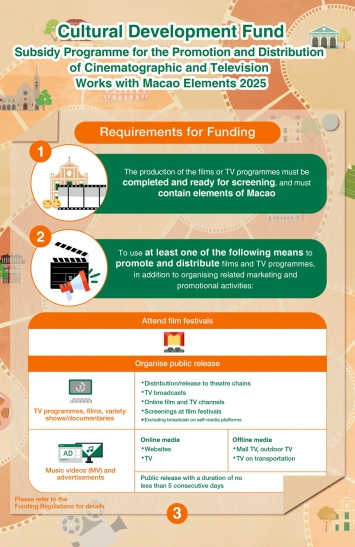

Requirements for funding

4.1The production of the films or TV programmes must be completed and ready for screening, and must contain elements of Macao, such as the use of Macao as a location, local cuisine, urban landscape, stories and legends, folklore and customs, history and culture, or stories and achievements of local personages as the theme. 4.2To use at least one of the following means to promote and distribute films and TV programmes, in addition to organising related marketing and promotional activities: 4.2.1Attend film festivals; 4.2.2Organise public release. 4.2.2.1The public screening of the TV programmes, films, variety shows/documentaries refers to the distribution/release to theatre chains, TV broadcasts, distribution/release to online film and TV channels, and screenings at film festivals, excluding broadcast on self-media platforms; 4.2.2.2Regarding the public broadcast of music videos (MV) and advertisements, it refers to the online media broadcast through website, TV and offline media (such as mall TV, outdoor TV, TV on transportation), with a duration of no less than 5 consecutive days. 4.3Projects subsidised by FDC shall not receive financial support from other public departments or public entities in Macao, nor shall they be granted funding by other subsidy programmes of FDC at the same time.

-

Application eligibility and target beneficiary

5.1The applicant should be the copyright holder of the film or television production, or the organisation authorised to use the film or television production, and meet any of the following criteria: 5.1.1A private entity that is constituted and operating in accordance with the law of Macao SAR; 5.1.2A non-local private entity that is constituted and operating in accordance with the law.

-

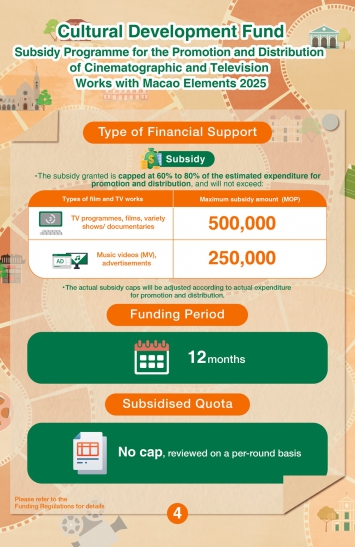

Type of financial support

6.1Subsidy.

-

Total budget, subsidised quota cap and maximum subsidy amount of this Subsidy Programme

7.1Total budget of this Subsidy Programme: 5 million patacas. 7.2Subsidised quota: No cap, reviewed on a per-round basis. However the number of subsidised projects finally approved will be limited by the aforesaid total budget of this Subsidy Programme. 7.3Subsidy: The subsidy granted is capped at 60% to 80% of the estimated expenditure for promotion and distribution (total amount outlined in points 8.1 and 8.2), and will not exceed the maximum amount listed below. Types of film and TV works Maximum subsidy amount (MOP) TV programmes, films, variety shows/ documentaries 500,000 Music videos (MV), advertisements 250,000 7.4The actual subsidy amount will be adjusted according to actual expenditure for promotion and distribution (please refer to point 9 Adjustment of subsidy for details).

-

Scope of subsidised and non-subsidised expenditure

8.1Expenditures eligible for subsidy and counted towards estimated expenditure include project-related expenses within the funding period: 8.1.1Lease expenses for venues, offices and other immovable properties: Limited to the rental payment for the venue of the screening events or promotional activities. Sublease requires legally compliant documentation; 8.1.2Rental expenses for equipment and other movable properties: Limited to the cost of renting equipment for screening events or promotional activities; 8.1.3Promotion and public relations expenses: Expenses for the purposes of distributing or promoting the film and television project, including costs of promotional materials, exhibitions, premieres, distribution (including releasing the work to cinema and listing the work on digital media), advertisements, and organising promotional activities; 8.1.4Traffic, travel and transportation expenses: ALimited to economy-class travel expenses for attending film festivals. For non-economy-class travel, if a reference economy-class price for the same itinerary is available (e.g., the economy-class fare for the same flight at the same time displayed on the airline’s official website), the subsidy will be calculated based on the economy-class fare, with the difference borne by the applicant; 8.1.5Accommodation expenses: Limited to (regular/standard room) accommodation expenses for attending film festivals. 8.2Project expenditures not eligible for subsidy but counted towards estimated expenditure include: 8.2.1Other expenses: Limited to the expenses for the implementation of agreed procedures. 8.3Expenses indicated in point 8.1 and point 8.2 can be considered as estimated expenditures for promotion and distribution, while other expenses, including the cost of services or products provided by the applicant, are excluded from the estimated expenditures.

-

Adjustment of subsidy

9.1If the actual expenditure of the subsidised project at the time of conclusion is lower than the estimated expenditure, the amount of subsidy granted will be adjusted on a pro rata basis as follows: [(estimated expenditure-actual expenditure)/estimated expenditure].

-

Funding period

10.1The funding period lasts 12 months, with the date count either starting from the next day after confirming the submission of the application online at the earliest for local private entity applicants, or from the next day after submitting the application slip personally at FDC for non-local private entity applicants, or from the first day in the following month after signing the agreement at the latest. The definite date should be designated under the negotiation of FDC and the beneficiary. 10.2The beneficiary shall complete the subsidised project within the funding period. 10.3Upon prior application by the beneficiary with rational justification during the funding period, the Administrative Council of FDC may grant one or multiple extensions on the funding period, provided that the aggregate extended period shall not exceed half of the original funding period.

-

Guarantee

11.1Should the applicant be a company entrepreneur (corporate body), its leading shareholder needs to present a credit guarantee to guarantee the beneficiary’s debt stemming from restoration or restitution of subsidy (for instance, withdrawal of subsidy, or the actual expenditure of the project is lower than the estimated expenditure), unless the leading shareholder is a public corporation. 11.2The beneficiary and guarantor mentioned above shall provide a guarantee by signing a promissory note equivalent to the subsidy amount and a declaration of responsibility. The relevant signatures shall be verified on-site.

-

Application

12.1If the applicant is: 12.1.1A local private entity, it should log in to FDC’s online application system with a physical user account of “Macao One Account”/ “Business & Associations Platform”; 12.1.2A non-local private entity, it should log in to the FDC’s online application system with a registered online account. 12.2After logging in to the system, the applicant should fill out an application form and upload the following documents: 12.2.1Supporting documents to prove the constitution and operation of the applicant in accordance with the law, as well as the identity document of the applicant’s legal representative (in the case of non-local private entity applicants). For private entities constituted and operating in accordance with the law of Macao SAR: 12.2.1.1Applicants who are individual entrepreneur (natural person) or company entrepreneur (corporate body) shall upload the following documents: 12.2.1.1.1Commercial Registration Certificate, if available; 12.2.1.1.2Supporting documents issued by the Financial Services Bureau proving that the applicant has no outstanding debt to the Macao SAR for any unsettled contribution, tax or other payables; 12.2.1.1.3Applicant’s most recent Business Tax – Tax Demand Note (M/8); 12.2.1.1.4Supporting documents for contributions to the Social Security Fund (an applicant not subject to any contribution obligation shall upload a declaration of no obligation); 12.2.1.1.5Profit and loss statement of the enterprise in the recent two years (preferably using the format specified by FDC). 12.2.1.2Applicants who are an association or a foundation shall upload the following documents: 12.2.1.2.1The Constitution published by the applicant in the Official Gazette of the Macao SAR (with Chinese and Portuguese versions in PDF format available on the website of the Printing Bureau); 12.2.1.2.2The “Certificate of the Leadership Structure of Established Association or Foundation” issued by the Identification Services Bureau, which includes the composition of an effective leadership structure. 12.2.2Proof that the applicant is the copyright holder of the proposed project, or the organisation authorised to use the film or television production; 12.2.3A detailed proposal for the promotion and distribution plan for the proposed project; 12.2.4Estimated cost for the promotion and distribution of the proposed project (preferably using the format specified by FDC); 12.2.5The applicant’s experience in the promotion and distribution of film and television works, including the CV and background of the project execution team, and other relevant information demonstrating applicant’s participations in other promotion and distribution projects; 12.2.6The film or television production of the proposed project that has been finalised for public release and screening (accessible as a download link, or presented with physical material that has been pre-filled in accordance with point 12.3); 12.2.7Other documents conducive to the approval of the application, if any, such as an introduction to the film and television work of the proposed project, introduction to the production team, agreements signed with other partners for the promotion and distribution of the production, quotations, etc., and any declaration documents for related-party transactions under point 19.5. 12.3Applicant needs to ensure the accuracy of the information submitted and the uploaded documents, and pre-fill the information of finished film or television work or other physical materials to be submitted due to the impossibility of electronic submission. The information cannot be changed once the submission of the application is confirmed online (for local private entity applicants)/the application slip is submitted at FDC (for non-local private entity applicants). 12.4Before the closing date of the application (5:30p.m. on 28th of November, 2025), applicants must visit FDC personally to submit the physical materials which their written desced apriptions have been submitted online in advance as mentioned in point 12.3. FDC does not accept late-submittplication documents/materials or those that are not pre-filled in the online system. 12.5Before the closing date of the application (5:30p.m. on 28th of November, 2025), non-local private entity applicants must visit FDC personally to submit the original application slip (with the applicant’s legal representative initialling on each page with a full signature and stamp on the last page for verification). 12.6Languages used in the application: Chinese, Portuguese or English. 12.7Rules and notes on application: 12.7.1Applicant may give consent to FDC for access the Commercial Registration Certificate and Debt-free Declaration mentioned in point 12.2.1.1.1 and point 12.2.1.1.2 respectively in order to waive the submission of relevant documents; 12.7.2FDC may require the applicant to present original documents, provide elaboration and submit documents, reports or information deemed indispensable for composing the application package; 12.7.3Upon submission, any change to the documents and information submitted will not be accepted unless otherwise notified by FDC; 12.7.4Applicant shall not make false declaration, provide false information or use other unlawful means to obtain the subsidy; 12.7.5Written notification shall be made to FDC immediately if the applicant decides to withdraw the application, and the application shall be considered terminated forthwith; 12.7.6All documents received by FDC for this Programme will not be returned.

-

Preliminary analysis

13.1Preliminary analysis will be conducted based on the application package, should any of the following circumstances occur, FDC will reject the application and not proceed to the review process: 13.1.1The proposed project is inconsistent with the purposes of FDC; 13.1.2The proposed project does not meet the objective under point 1; 13.1.3The proposed project does not fall within the scope of funding under point 3; 13.1.4The proposed project does not meet the requirements for funding under point 4; 13.1.5The proposed project does not fall within the eligibility criteria and target beneficiary as mentioned in point 5; 13.1.6The application documents do not comply with the application requirements referred to in point 12; 13.1.7The applicant has pending subsidy to be repaid, returned or refunded in other subsidised projects of FDC; 13.1.8The applicant is on FDC’s rejection list of subsidy; 13.1.9The application falls within the scope of subsidy programmes announced by other public departments/public entities in Macao; 13.1.10The applicant applies for the same project repeatedly (for the same project, the first submission of application shall prevail); 13.1.11The films or TV programmes under the proposed project is categorised as erotic film according to Law No. 10/78/M of 8th July (Measures for the sale, display and exhibition of pornographic and obscene material in local district), or is classified as pornographic film outside Macao; 13.1.12The proposed project contains inappropriate elements, such as indecency, violence, pornography, obscenity, gambling, foul language, defamation, or infringement of the rights of others; 13.1.13The proposed project contains content endangering national security, or contrary to public order or good morals; 13.1.14The proposed project involves damage to the image and reputation of the Macao SAR Government or FDC; 13.1.15The proposed project negatively impacts the image of the Macao SAR; 13.1.16The applicant fails to submit the supplementary documents within the specified period, or the supplementary documents are non-compliant. 13.2If the documents outlined in points 12.2.1 to 12.2.2 are not submitted or non-compliant, FDC may require the applicant to submit the relevant documents within 5 days. 13.3Should there be no objection to the application, the Administrative Council of FDC will send the application package to the Activity and Project Assessment Committee for review.

-

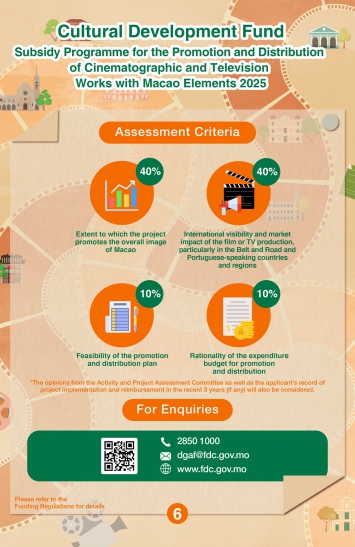

Review and grant decision

14.1Three to seven experts from the expert list in areas of film and TV, academics and commercial sectors will be invited to be the members of the Activity and Project Assessment Committee by the chairperson of the Administrative Council according to the nature of the project that needs to be reviewed. 14.2Meeting of the Activity and Project Assessment Committee could be held only with the attendance of at least half of all members, and minutes need to be taken with the record of review results and important matters in each meeting. 14.3The representative of the applicant needs to attend the review meeting to introduce the content of the proposed project and answer the questions raised by the review panel. If the applicant cannot attend the meeting due to a rational justification, a document review will be conducted based on the submitted documents, or the application will be considered abstained. 14.4The Activity and Project Assessment Committee will rate according to the following assessment criteria (the full score is 100): 14.4.1Extent to which the project promotes the overall image of Macao (40%); 14.4.2International visibility and market impact of the film or TV production, particularly in the Belt and Road and Portuguese-speaking countries and regions (40%); 14.4.3Feasibility of the promotion and distribution plan (10%); 14.4.4Rationality of the expenditure budget for promotion and distribution (10%). 14.5An application will be considered passed with a score of no less than 60. 14.6The granting entity will decide on the application and may impose additional conditions after fully considering the following opinions and records: 14.6.1Opinions of the Activity and Project Assessment Committee; 14.6.2The applicant’s record of implementation and reimbursement of the subsidised activities and projects in the recent 3 years (including records of written warning or withdrawal of subsidy), if any. 14.7The Administrative Council of FDC may request the applicant to adjust the content of the proposed project within a specified period based on its own review or opinions from the Activity and Project Assessment Committee. 14.8The amount of the approved subsidy depends on the budget scale and assessment score of the proposed project. 14.91The Administrative Council of FDC may decide not to approve subsidy under the following circumstances: 14.9.1The proposed project fails to pass the review; 14.9.2The applicant violates the provisions of point 14.7; 14.9.3The budget of this Subsidy Programme is exhausted; 14.9.4It is subsequently discovered that the proposed project falls within the circumstances referred to in point 13.1.

-

Agreement

15.1An agreement containing the content of the grant decision must be signed between FDC and the beneficiary. 15.2Consequences of failure to sign the Agreement: If the beneficiary fails to sign the Agreement during the period (generally within 30 days of notification), at the time and at the place specified by FDC, the approval shall become invalid, unless the failure is due to force majeure or for reasons which, in the opinion of the Administrative Council of FDC, are not attributable to the beneficiary.

-

Changes to project content

16.1No application is required for the following changes that do not involve deviation from the core content of the subsidised project, the beneficiary can make flexible adjustments according to the specific implementation, and provide explanation when submitting the report: 16.1.1Related promotional activities. 16.2Caso as alterações do projecto financiado envolvam o conteúdo crítico, em particular nas seguintes situações, o beneficiário deve apresentar requerimento prévio para uma aprovação pelo FDC: 16.2.1Reducing or changing broadcast channels as originally planned; 16.2.2Reducing or changing the film festivals as originally planned to attend; 16.2.3Adding, reducing or changing the original shareholders, members of the administrative body; 16.2.4Reducing or changing more than half of the key members of the project team listed in the application form.

-

Submission of summary report and report on the implementation of agreed procedures

17.1The beneficiary must inform FDC in writing of the certified public accountants, accounting firms, accountants who can provide accounting and taxation services, and accounting firms who can provide accounting and taxation services for the project within 60 days from the day after signing the agreement and submitting the relevant Engagement Letter. 17.2The beneficiary is required to submit to FDC the following reports on time and in the format specified by FDC: 17.2.1The beneficiary must submit to FDC the summary report within 30 days after project completion, followed by the report on the implementation of agreed procedures within 90 days (the beneficiary shall, at its own expense, engage a certified public accountant (practising), a firm of accountants, an accountant who can provide accounting and taxation services, an accounting firm who can provide accounting and taxation services, and shall perform the agreed procedures for the income, expenditure and financial situation of the subsidised project); 17.2.2The beneficiary must submit the above report documents in accordance with the preparation requirements. 17.3The format of the Engagement Letter referred to in point 17.1 and the report on the implementation of agreed procedures referred to in point 17.2.1 must comply with the “Instructions for the Inspection of Subsidised Activities or Projects” (No.001/GPSAP/AF/2023) issued by the Public Assets Supervision and Administration Bureau (DSGAP). 17.4Supporting documents attached to the report: When submitting the summary report, the beneficiary is required to attach supporting documents, including but not limited to the following: Documentary proof Related to disclosure, promotion and distribution ‒ Contract of distribution

‒ Promotional images (e.g. leaflets, posters, etc.)

‒ Proof of promotion (e.g. photos of physical promotional activities, screenshots and click-through data of online promotion, promotional video files, etc.)

‒ Media coverage

‒ Photos of attending film festivals (no less than 6 photos from each film festival)

‒ Photos from the premieres (no less than 12 photos)

‒ Public screening information and relevant proof of sales channels (including screenshots of online sales platforms or distribution/ screening channels of film and TV websites)

‒ Proof of screening efficacy (including proof of box office statistics; if the screening takes place on film and TV website or online broadcasting platforms, proofs such as clicks and traffics must be provided)

‒ Proof of awards17.5Application for delay in report submission: If the report cannot be submitted within the period specified in point 17.2 due to force majeure or other reasons not attributable to the beneficiary, the beneficiary shall notify FDC within 7 working days from the date of occurrence of the relevant fact. 17.6In the aforementioned cases, subject to the approval of the Administrative Council of FDC, the period for submitting the report shall be within 30 days from the day following the disappearance of the abovementioned reasons, without prejudice to the application of the following provisions. 17.7In exceptional and justified cases, the Administrative Council of FDC may approve one extension of period, as mentioned in point 17.2, but not exceeding 90 days. 17.8Should FDC deem the documents unclear or incomplete, the beneficiary will have to submit supplementary documents within the period specified by FDC. Failure to submit the supplementary documents within the specified period or submission of non-compliant documents may result in project closure based on the existing submitted documents without prejudice to the consequences of late submission, except for force majeure or other reasons not attributable to the beneficiary. FDC may withdraw the subsidy, if the project does not meet the conditions for project closure.

-

Recognition of expenditure

18.1Purposes and mandatory nature of expenditure recognition: To ascertain that the actual expenditure incurred by the beneficiary in respect of the subsidised activities and projects abides by the permissible scope as set out in this Regulation, the expenditure shall be recognised by FDC. 18.2Method of recognition: The subsidy is recognised in the form of reimbursement through the submission of the report on the implementation of the agreed procedures by the beneficiary. The beneficiary shall keep original receipts of income and expenditure of the subsidised project intact for at least 5 years for inspection by FDC, if necessary. 18.3Requirements on receipts: 18.3.1Expenditures payable to a company or organisation: Relevant proof of expenditure, such as invoices or receipts issued by the company or organisation bearing the names of the buyer and the seller, name of the product or service, date of issue, voucher number, amount, and contact information of the seller, e.g. address, phone number, email address, etc., or the beneficiary shall indicate the above contact details of the company or organisation concerned. In the case of leased property, the invoice or receipt should also contain the property’s address in addition to the above information. 18.3.2Expenditures payable to a natural person: Relevant proof of expenditure, such as receipts issued by natural persons (with the names of the buyer and seller, name of the product or service, date of issue, voucher number, amount and contact information of the seller, e.g. address, phone number, email address, etc., or the beneficiary shall indicate the above contact details), M/7-Professional Tax Form (containing the name of the customer and the issuer, service name, issuer’s tax ID number, date of issue, voucher number, and the business activity and amount as set out in the Table of the Professional Tax Regulation). 18.3.3Other requirements for receipt: 18.3.3.1When the expense amount on the receipt involves a discount, the actual payment amount shall be stated; 18.3.3.2For transactions using the FDC subsidy amounting to 100,000 patacas or more, the receipts shall be paid invoices or receipts of the payments. The beneficiary shall submit proof of payment transactions (e.g. copies of cheques, transfer records, online payment records, and physical evidence of expenditures such as physical photographs, photographs of service delivery in the case of cash payments). A formal invoice in the local standardised format is also required in the case of a transaction paid to a mainland entity; 18.3.3.3For transactions involve currencies other than Pataca (MOP), the beneficiary needs to specify the currency and its exchange rate with MOP; 18.3.3.4If the information on the receipt is incomplete, the beneficiary must provide a written explanation with their signature and the date of signing on the relevant document; 18.3.3.5If an amendment of information on the receipt is needed, the relevant product or service provider shall amend according to the fact, and stamp on the amended area for verification; 18.3.3.6If the transaction involves “transactions with related parties”, as referred to in point 19 below, the beneficiary should make a note on the receipt and provide the contact information of the relevant transaction party.

-

Transactions with related parties

19.1For the purposes of this Regulation, a “related party” refers to a party that is related to the applicant or beneficiary, the scope of which is as follows: If the applicant/beneficiary is an individual entrepreneur (natural person), the related parties include: If the applicant/beneficiary is a company entrepreneur (corporate body), the related parties include: If the applicant/beneficiary is an association or a non-profit organisation, the related parties include: 1. The spouse, child, parent, sibling, parent-in-law, sibling-in-law of the applicant/beneficiary, as well as the individual in a de facto relationship with his/her;

2. A natural person enterprise held by the applicant/beneficiary;

3. A company where the applicant/beneficiary serves as a controlling shareholder1 or member of the administrative body;

4. A natural person enterprise held by those referred to in point 1;

5. A company where those referred to in point 1 serves as a controlling shareholder or member of the administrative body.

1 “Controlling shareholder” refers to a natural person or legal entity who alone holds the majority of the company’s capital contribution; or jointly holds the majority of the company’s capital contribution with other companies that are also controlling shareholders, or with other shareholders connected through quasi-company agreements; or holds more than half of the voting rights; or has the right to elect the majority of members of the administrative body.1. The controlling shareholder (including natural person and corporate shareholder, especially its parent company) and member of the administrative body of the applicant or subsidised company, as well as their spouses, children, parents, siblings, parents-in-law, siblings-in-law, and those who have a de facto marital relationship with them;

2. A company where the applicant or subsidised company serves as a controlling shareholder, especially its subsidiary, is also a related party;

3. A natural person enterprise held by those referred to in point 1;

4. If those referred to in point 1 serve as a controlling shareholder or member of the administrative body in another company, that company is a related party of the applicant or subsidised company.1. The President/Director/ Chief Supervisor/ Secretary General/Headmaster or equivalent position holder of the applicant or subsidised association/non-profit organisation;

2. The Vice-President/Deputy Director/Vice Chief Supervisor/Deputy Secretary General/Vice Headmaster or equivalent position holder of the applicant or subsidised association/non-profit organisation, except for those who have not actually participated in the procurement process related to such transaction;

3. If those referred to in the above two points hold any of the positions indicated above in another association or non-profit organisation, or serve as an individual entrepreneur (natural person) of another enterprise, or serve as a controlling shareholder or member of the administrative body of another company, that association/non-profit organisation/enterprise/ company is a related party of the applicant or subsidised association/non-profit organisation, without prejudice to the application of the latter part of the above point.

4. If the spouse, child, parent, sibling, parent-in-law, sibling-in-law of those referred to in points 1 and 2, as well as the individual in a de facto relationship with his/her, hold any of the positions indicated in points 1 and 2 in another association or non-profit organisation, or serve as an individual entrepreneur (natural person) of another enterprise, or serve as a controlling shareholder or member of the administrative body of another company, that association/non-profit organisation/enterprise/ company is a related party of the applicant or subsidised association/non-profit organisation, without prejudice to the application of the latter part of point 2.19.2When conducting related-party transactions, the applicant or beneficiary shall ensure fair and reasonable practises, particularly the transaction price shall be market-aligned. 19.3In the case that the related-party transactions under the following circumstances are to be made or have been made by the applicant during the application stage; or have been made by the beneficiary during the project implementation stage, the applicant/beneficiary shall declare in the application documents or summary report respectively, without prejudice to the following provisions: 19.3.1The cumulative amount of transactions between the applicant/beneficiary and the same related party is expected to reach or actually reaches 50,000 patacas or more, whether or not the FDC subsidy is used. 19.4In the event of the above circumstance to be declared and the amount of the used FDC subsidy reaches 50,000 patacas or more, the applicant/beneficiary shall also provide supporting documents to prove that additional quotations have been made in advance to at least two non-related suppliers (i.e. suppliers other than the related parties mentioned in point 19.1), and the following provisions apply: 19.4.1The quotation proof documents shall include a declaration from the supplier stating that it is “not affiliated with, and has not previously collaborated on pricing” with other suppliers participating in the quotation; 19.4.2FDC will use the lowest price quote as the upper limit for expenditure; 19.4.3The failure to submit the relevant quotation proof documents will result in the related expenditure not being reimbursed by FDC, without prejudice to the following provisions; 19.4.4If the related party has exclusive rights to the goods or services provided, no quotation is required, but relevant proof of exclusivity shall be submitted (proof documents are not required for widely-recognised exclusive rights holders). 19.5Declarations of the related-party transactions shall include: 19.5.1The name/title, contact information of the related party; 19.5.2The relationship between the related party and the applicant/beneficiary; 19.5.3Transaction details, including: the expected or actual date of the transaction, the subject matter and the amount; 19.5.4Justifications for conducting the related-party transaction, for example: more preferential price than market price; the related party has technical or professional capabilities to outperform similar entities; the related party has exclusive rights to the goods or services provided; 19.5.5Supporting documents or information proving that the related-party transaction is justified. 19.6For the purpose of application of point 19.5.5, the beneficiary may use the quotation documents referred to in point 19.4 as the proof of reasonable transaction price. 19.7In the case that change occurs on the declarations of the expected or completed related-party transaction during the funding application stage, the beneficiary should update such information in the summary report. 19.8If the applicant/beneficiary violates the provisions of this Regulation regarding related-party transactions, the Administrative Council of FDC may not approve the related expenditure. In the event of severe cases, the Administrative Council of FDC may reject the application, not approve or withdraw the subsidy depending on the actual stage of the case.

-

Subsidy distribution methods

20.1Subsidy will be distributed according to the following proportion, without prejudice to the following provisions: Payment Initial

(after signing agreement)Final

(after approving summary report)Subsidy distribution proportion 50% 50% 20.2If the beneficiary violates the obligations under other FDC subsidy programmes, FDC may suspend the disbursement until the relevant obligations are fulfilled.

-

Beneficiary obligations

21.1Beneficiary must fulfil the following obligations: 21.1.1Provide truthful information and make declarations; 21.1.2Use the subsidy for the purposes specified in the grant decision; 21.1.3Plan and organise subsidised projects prudently and rationally; 21.1.4When conducting related-party transactions, ensure fair and reasonable practises, particularly the transaction price shall be market-aligned; 21.1.5Submit the reports and supporting documents indicated in point 17 on time; 21.1.6Accept and comply with FDC in monitoring the use of subsidy, including the inspection of related income and expenditure and financial status; 21.1.7Return subsidy in accordance with point 23.3.1; 21.1.8Return unused subsidy with specific purpose; 21.1.9Retain original proof of income and expenditure of the subsidised project intact for at least 5 years; 21.1.10Open a dedicated Macao bank account (MOP) in the name of the beneficiary for the subsidised project for deposit of project subsidy. Beneficiary can deposit the income of the project and their own funds into this account, however, it is necessary to ensure that all unused subsidy is deposited in this account. If the unused subsidy is deposited into other accounts for operation-related reasons, the beneficiary needs to provide relevant supporting documents; 21.1.11Cooperate proactively with the monitoring work, training or promotional campaigns of FDC on the project, and agree that FDC has the right to keep account of the whole process of the project through word, filming, photographing and recording in other forms; 21.1.12List the wordings “Funded by Macao SAR Cultural Development Fund” or “Funding Unit: Macao SAR Cultural Development Fund” or similar statements in any promotional campaigns, press releases and promotional materials related to the project, including designated text, graphics and logos if requested by FDC; 21.1.13Agree that after signing the agreement, the basic information and results of the subsidised project will be published on the website of FDC and public documents, especially photos, texts, graphic files, and data, for promotional purposes; 21.1.14Agree that FDC may provide the project-related data to or obtain such data from other public authorities or entities, for the purpose of verifying the circumstances referred to in point 4.3; 21.1.15Ensure that the content of the proposed project and the project implementation procedures are not in violation of legal provisions; ensure that the project results do not negatively impact the image of the Macao SAR; ensure the legality of the project results and the production process, including the tools used, measures taken, and information obtained; and ensure that the project does not involve inappropriate elements, such as indecency, violence, pornography, obscenity, gambling, foul language, defamation, or infringement of third-party rights; 21.1.16Not engage in acts that endanger national security, or contrary to public order or good morals; 21.1.17Not engage in acts detrimental to the image and reputation of the Macao SAR Government or FDC; 21.1.18Not engage in acts that negatively impact the image of the Macao SAR; 21.1.19Comply with the terms stipulated in the signed agreement with FDC; 21.1.20Comply with the guidelines for monitoring issued by FDC and DSGAP; 21.1.21Comply with the Administrative Regulation No. 18/2022 “Public Financial Aid System of the Macao Special Administrative Region”, No. 5/2023 “Regulations on Funds Granted by the Cultural Development Fund”, approved by the Secretary for Social Affairs and Culture, other applicable laws and regulations and the provisions of this Regulation.

-

Termination of operation or failure to complete activities and projects

22.1In case of any of the following, FDC may approve the beneficiary’s application for termination of the implementation of the project during the funding period, without prejudice to point 23.1: 22.1.1It is expected that the project cannot be completed during the funding period due to force majeure or reasons confirmed by FDC that are not attributable to the beneficiary; 22.1.2The beneficiary undertakes to return in full the subsidy it has collected. 22.2In the case mentioned in point 22.1.1 and also approved by FDC, the beneficiary shall submit a summary report within the period specified by FDC for the purpose of the closure process. 22.3In the case mentioned in point 22.1.2 and also approved by FDC, the beneficiary shall, within 30 days from the date of receipt of the notification on approval of the application, return in full the subsidy it has collected, otherwise, FDC will make a compulsory withdrawal and reject all subsidy applications made by the beneficiary within two years from the date of expiration of the return period. 22.4If the application referred to in point 22.1 is not approved, the beneficiary shall continue to implement the relevant project, otherwise FDC will withdraw the subsidy. 22.5If the beneficiary fails to complete the project due to force majeure or reasons confirmed by FDC that are not attributable to the beneficiary at the end of the funding period, FDC shall proceed to the closure procedure. If the reason is not approved by FDC, the subsidy will be withdrawn. 22.6If the project cannot be completed due to reasons other than those mentioned above, FDC may withdraw the subsidy.

-

Withdrawal of subsidy

23.1Circumstances leading to compulsory withdrawal of subsidy by FDC: 23.1.1Beneficiary makes false statements, provides false information or uses other illegal means to obtain subsidy; 23.1.2Beneficiary uses the subsidy for purposes other than those specified in the grant decision; 23.1.3Beneficiary violates the obligations of prudent, reasonable planning and organisation on the subsidised activity or project, leading to serious risks or damages to the parties taking part in the activity or project or the public interest, especially public safety or social order; 23.1.4Beneficiary engages in acts that endanger national security, or violate public order or good morals; 23.1.5Beneficiary engages in acts detrimental to the image and reputation of the Macao SAR Government or FDC; 23.1.6The films or TV programmes under the subsidised project is categorised as erotic film according to Law No. 10/78/M of 8th July (Measures for the sale, display and exhibition of pornographic and obscene material in local district), or is classified as pornographic film outside Macao; 23.1.7The subsidised project contains inappropriate elements, such as indecency, violence, pornography, obscenity, gambling, foul language, defamation, or infringement of the rights of others; 23.1.8No longer meets the objective in point 1, the scope of funding in point 3, requirements for funding in point 4, application eligibility and target beneficiary in point 5, or that an inappropriate incident has not been rectified within the period specified by FDC; 23.1.9Other circumstances requiring withdrawal of subsidy as provided in this Regulation. 23.2Circumstances leading to possible withdrawal of subsidy by FDC: 23.2.1The result of progress review of the subsidised project shows a deviation from the core; 23.2.2The application for changes referred to in point 16.2 is not approved, however, the beneficiary continues to implement the changed content; 23.2.3The circumstances referred to in point 17.8; 23.2.4The subsidised project negatively impacts the image of the Macao SAR; 23.2.5The circumstances referred to in points 22.4 to 22.6; 23.2.6Violation of other provisions of this Regulation. 23.3Consequences of withdrawal of subsidy: 23.3.1The beneficiary must return the subsidy in full within 30 days from the date of receiving the relevant notification; 23.3.2In the case mentioned in point 23.1, FDC shall not accept any subsidy application submitted by the beneficiary within two years from the date the notification of the consequences of withdrawal of subsidy is issued; 23.3.3In the case mentioned in point 23.2, FDC may simultaneously impose a two-year ban on the beneficiary’s future applications from the date the notification of the consequences of withdrawal of subsidy is issued. 23.4Consequences of failure to return the subsidy mentioned in point 23.3.1: 23.4.1If the beneficiary fails to return the arrears of the granted subsidy within the specified period without well-grounded reasons in writing, the Tax Enforcement Office of the Financial Services Bureau will make a compulsory withdrawal.

-

Consequences of late submission of reports or supporting documents — subsidy reductions

24.1If a beneficiary is late in submitting reports or supporting documents, FDC may make the following deductions from the subsidy: Scenarios Subsidy deductions Submission of a summary report, report on the implementation of agreed procedures, or the relevant supporting documents beyond the deadline (unless an extended period is approved) 1. Depending on the frequency of occurrences, the subsidy for the project shall be deducted according to the corresponding percentages:

- 1st overdue: deducting 5%

- 2nd overdue or more: deducting 10%

2. The above subsidy deduction is cumulative with point 9 (Adjustment of subsidy): the amount of subsidy after deduction = actual subsidy*(1-A)*(1-B), with A and B representing subsidy adjustment and deduction ratio respectively.

Notes:

A refers to the subsidy adjustment ratio mentioned in point 9.

B refers to the subsidy deduction percentage due to late submission of reports and supporting documents.

-

Written warning

25.1FDC may issue a written warning if the beneficiary violates the provisions of this Regulation, in particular the Beneficiary obligations under point 21.

-

Others

26.1FDC only provides subsidy for the subsidised project and does not participate in any commercial activities or business decisions of the beneficiary. All decisions, activities, statements, etc. made by the beneficiary in relation to the project or otherwise do not represent the stance of FDC. 26.2The beneficiary must abide by the laws of the Macao SAR, mainland China and other countries and regions. If any activities or decisions made by the beneficiary lead to civil, criminal or administrative liabilities in violation of the laws of the Macao SAR, mainland China or other countries and regions, the beneficiary shall assume their own responsibilities. 26.3The beneficiary shall apply to relevant departments (including in Macao and outside Macao) and obtain types of licenses and permits necessary for the project. 26.4By participating in this Programme, the applicants are deemed to have read, understood and agreed to abide by all terms and conditions of this Regulation without objection. 26.5Matters not mentioned in this Regulation will be regulated by the current laws and regulations applicable to the Macao SAR, especially the Administrative Regulation No. 40/2021 “Organisation and Operation of the Cultural Development Fund”, the Administrative Regulation No. 18/2022 “Public Financial Aid System of the Macao Special Administrative Region”, No. 5/2023 “Regulations on Funds Granted by the Cultural Development Fund”, approved by the Secretary for Social Affairs and Culture, and other relevant regulations on the subsidy of Cultural Development Fund. 26.6FDC has the final right of interpretation and decision on this Regulation.

-

For enquiries

Tel: 2850 1000. Fax: 2850 1010. Email: dgaf@fdc.gov.mo.

Only available in Chinese and Portuguese